From 1 Oct 2018, consumer tax in Japan will be raised from 8% to 10%. However, the tax increase will be omitted for items like daily necessities. So, what are the items that will be taxed at 8% and what will be taxed at 10%??

There have been concerns raised over a possible confusion among consumers and retailers regarding 2 different tax categories.

Allow me to explain briefly what falls under which category.

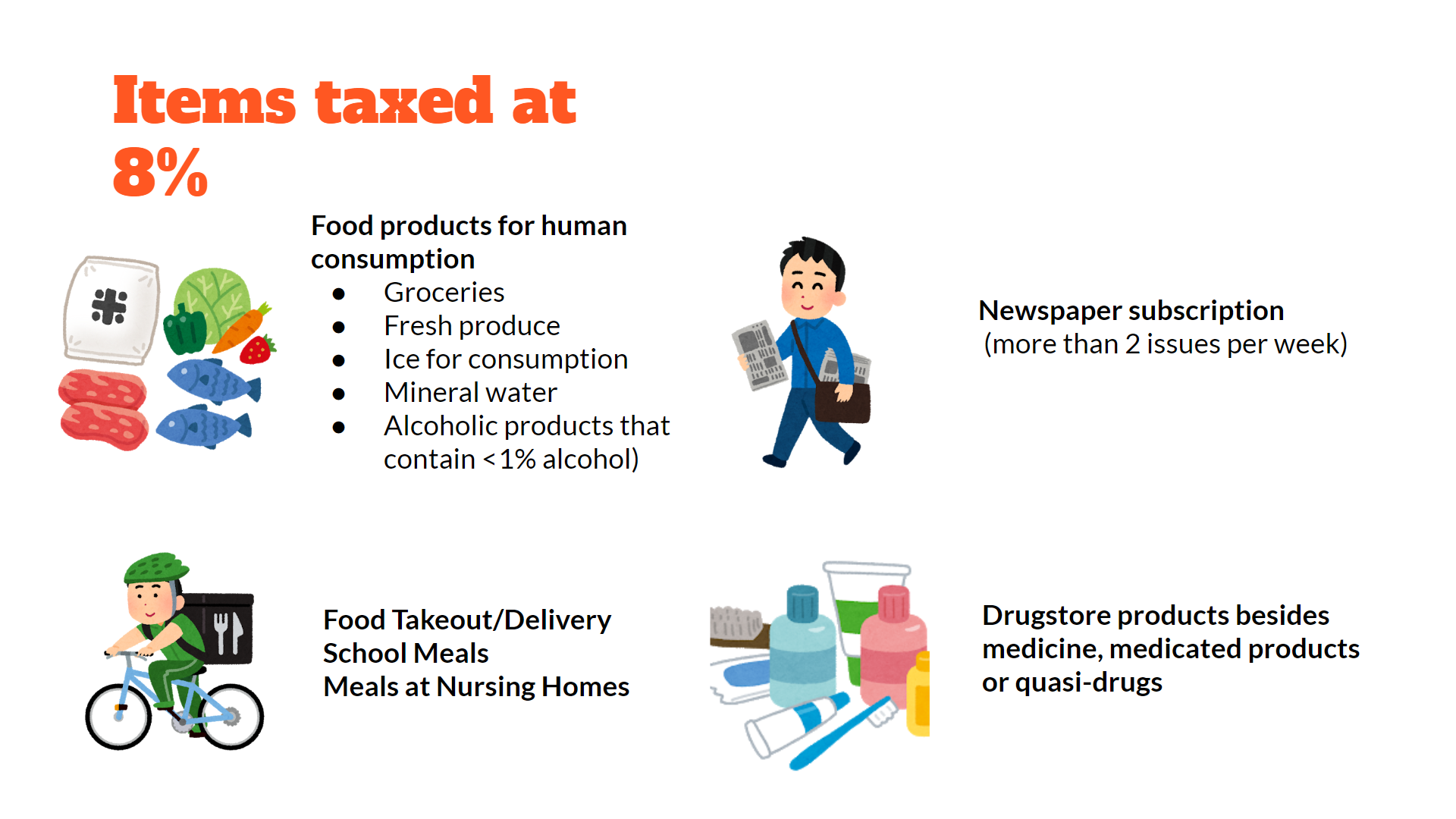

Items taxed at 8%:

・Food products for human consumption (Groceries, Fresh produce, Ice for consumption, Mineral water, Alcoholic products that contain <1% alcohol)

・Food Takeout/Delivery, School Meals, Meals at Nursing Homes

・Newspaper subscription (more than 2 issues per week)

・Drugstore products besides medicine, medicated products or quasi-drugs

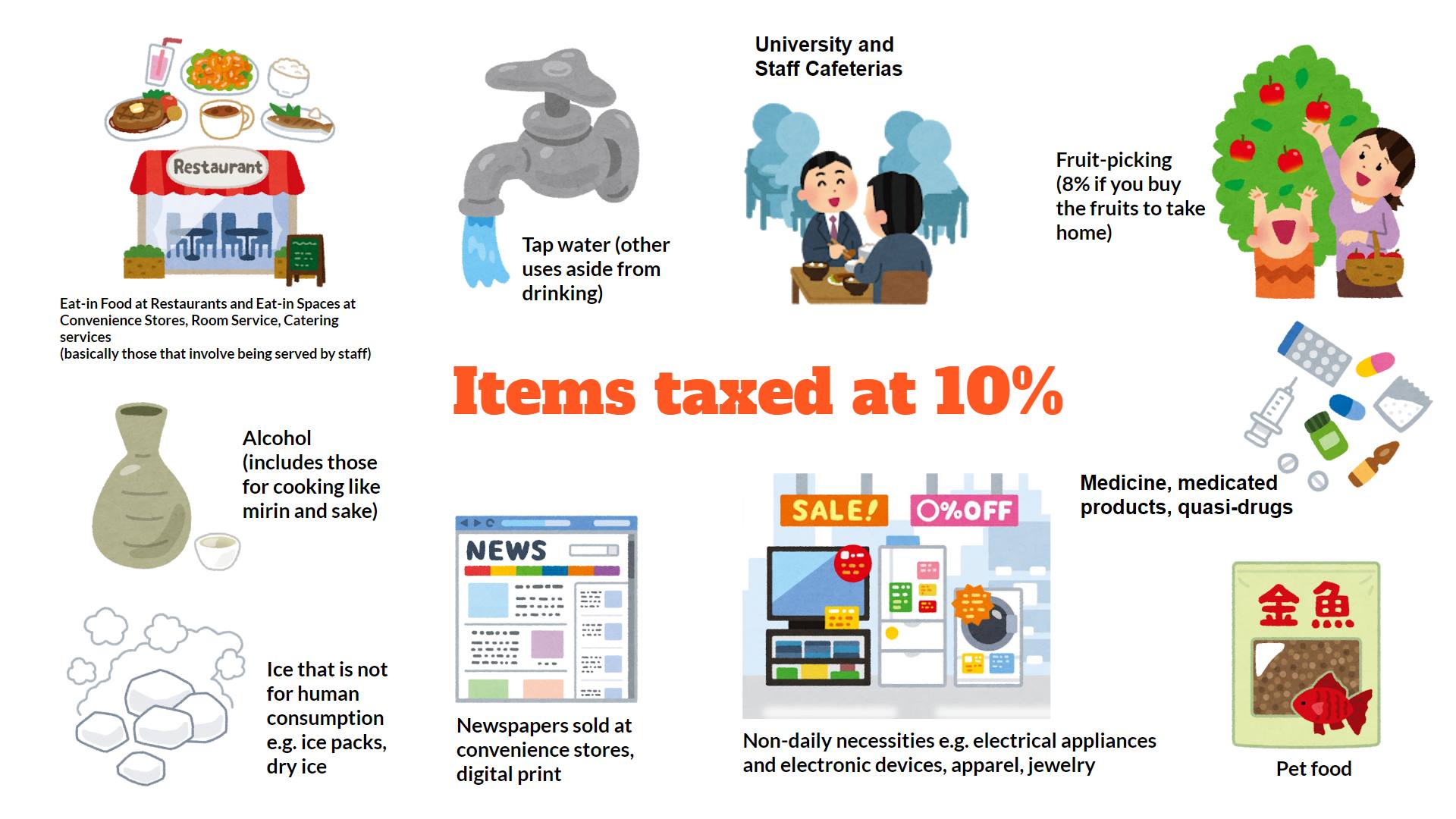

Items taxed at 10%:

・Non-daily necessities e.g. electrical appliances and electronic devices, apparel, jewelry

・Alcohol (includes those for cooking like mirin and sake)

・Ice that is not for human consumption e.g. ice packs, dry ice

・Tap water (other uses aside from drinking)

・Pet food

・Eat-in Food at Restaurants and Eat-in Spaces at Convenience Stores, Room Service, Catering services (basically those that involve being served by staff)

・University and Staff Cafeterias

・Fruit-picking (8% if you buy the fruits to take home)

・Newspapers sold at convenience stores, digital print

・Medicine, medicated products, quasi-drugs

There have been concerns raised over a possible confusion among consumers and retailers regarding 2 different tax categories.

Allow me to explain briefly what falls under which category.

Items taxed at 8%:

・Food products for human consumption (Groceries, Fresh produce, Ice for consumption, Mineral water, Alcoholic products that contain <1% alcohol)

・Food Takeout/Delivery, School Meals, Meals at Nursing Homes

・Newspaper subscription (more than 2 issues per week)

・Drugstore products besides medicine, medicated products or quasi-drugs

Items taxed at 10%:

・Non-daily necessities e.g. electrical appliances and electronic devices, apparel, jewelry

・Alcohol (includes those for cooking like mirin and sake)

・Ice that is not for human consumption e.g. ice packs, dry ice

・Tap water (other uses aside from drinking)

・Pet food

・Eat-in Food at Restaurants and Eat-in Spaces at Convenience Stores, Room Service, Catering services (basically those that involve being served by staff)

・University and Staff Cafeterias

・Fruit-picking (8% if you buy the fruits to take home)

・Newspapers sold at convenience stores, digital print

・Medicine, medicated products, quasi-drugs